In a Business Times article last Thursday, 03 September 2020, it was reported that Parkway Life REIT (SGX:C2PU) will be included in the FTSE EPRA NAREIT Global Developed Index after trading hours next Friday, 18 September 2020 (you can read the article in full here.)

Many of them dubbed this healthcare REIT the ‘best REIT’ in Singapore for its strong business fundamentals. This REIT is also on my ‘shopping list.’

In this post, I will be sharing with you the REIT’s historical financial performances, debt, and occupancy profile, along with its distribution payout (to unitholders) between FY2015 and FY2019, as well as its key performance statistics for the first half of FY2020 (compared against the same time period last year.)

First up, some brief introduction about the healthcare REIT:

Brief Introduction about Parkway Life REIT

Listed on the Singapore Exchange since 23 August 2007 at an IPO price of S$1.28/unit, had you invested in the REIT back then, and continued to stay invested throughout, based on its unit price of S$3.98 at the time of writing (on 10 September 2020), you will be sitting on a capital appreciation of more than 200% (that’s excluding all the distribution payouts you have received throughout the years.)

As at 31 December 2019 (which is the financial year end for the REIT), Parkway Life REIT’s portfolio consists of a total of 53 properties in Singapore (consisting of 3 private hospitals in Mount Elizabeth Hospital, Gleneagles Hospital, and Parkway East Hospital), Malaysia (MOB Specialist Clinics, in Kuala Lumpur), as well as in Japan (where the REIT has a total of 48 nursing homes in the various Prefectures, along with one pharmaceutical product distributing facility, with all but one of the properties seated on freehold land.)

Historical Financial Performance of Parkway Life REIT between FY2015 and FY2019

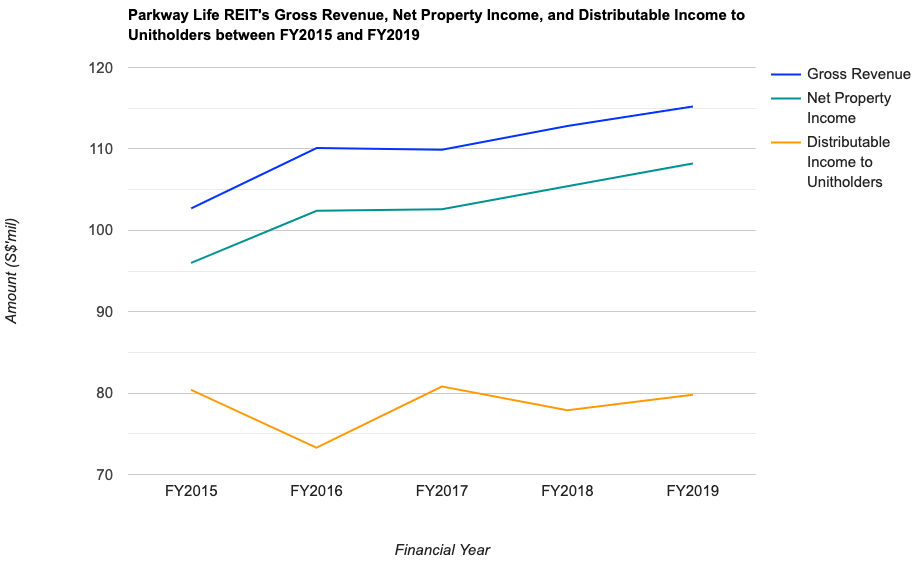

In this section, let us take a look at the historical financial performances of Parkway Life REIT over a 5-year period – between FY2015 and FY2019:

| FY2015 | FY2016 | FY2017 | FY2018 | FY2019 | |

| Gross Revenue (S$’mil) | $102.7m | $110.1m | $109.9m | $112.8m | $115.2m |

| Net Property Income (S$’mil) | $96.0m | $102.4m | $102.6m | $105.4m | $108.2m |

| Distributable Income to Unitholders (S$’mil) | $80.4m | $73.3m | $80.8m | $77.9m | $79.8m |

Parkway Life REIT’s gross revenue, over a 5-year period, grew at a compound annual growth rate (CAGR) of 2.3%. Its gross revenue saw year-on-year (y-o-y) improvements every single year except for in FY2017, where it saw a marginal 0.2% y-o-y dip due to a depreciation of the Japanese Yen against the Singapore dollar (which the REIT reports its financial results in.)

The REIT’s net property income saw improvements every single year over a 5-year period, and a CAGR of 2.4%.

However, its distributable income to unitholders saw y-o-y declines in 2 out of the 5 financial years I have looked at, which can be attributed to:

FY2016: A lack of a one-off distribution of divestment gains (arising from the REIT’s divestment of 7 Japan properties in December 2014) which had been distributed to unitholders over 4 quarters in the preceding year, FY2015

FY2018: Again due to a lack of one-off divestment gains (following the REIT’s divestment in December 2016) which was fully distributed to unitholders over 4 quarters in the previous year, FY2017

Over the years, the REIT’s distributable income to unitholders have been hoovering around the S$70+m and S$80m range.

Debt Profile of Parkway Life REIT between FY2015 and FY2019

One of the components I study when I research about a REIT is its debt profile, where my preference is towards investing in REITs with a low gearing ratio and average cost of debt, as well as one that has a high interest coverage ratio.

With that, let us now take a look at Parkway Life REIT’s debt profile over the past 5 years:

| FY2015 | FY2016 | FY2017 | FY2018 | FY2019 | |

| Gearing Ratio (%) | 35.3% | 36.3% | 36.4% | 36.1% | 37.1% |

| Interest Cover Ratio (times) | 9.8x | 8.7x | 11.3x | 13.7x | 14.1x |

| Average Term to Debt Maturity (years) | 3.5 years | 3.6 years | 3.1 years | 2.9 years | 2.8 years |

| Average Cost of Debt (%) | 1.6% | 1.4% | 1.0% | 1.0% | 0.8% |

My Observations:

- Its gearing ratio over a 5-year period, have been hoovering between 35% and 37% – which is a safe distance away from the new regulatory limit of 50.0%, meaning there remains plenty of debt headroom for the REIT to make further yield accretive acquisitions should any opportunities to do so arises.

- What impressed me the most is how its average cost of debt have gradually been coming down over the years – from 1.6% to FY2015 to just 0.8% in FY2020 (which is one of the lowest in S-REITs.)

- Finally, its interest coverage ratio have also risen steadily since FY2016, suggesting that the REIT is more than able to fulfil its interest payments on outstanding debt.

- All in all, I must say that Parkway Life REIT has a very conservative debt profile.

Portfolio Occupancy Profile of Parkway Life REIT between FY2015 and FY2019

Another thing I look at if the company I’m studying is a REIT is its portfolio occupancy profile.

Let us take a look at Parkway Life REIT’s occupancy occupancy rate, along with its portfolio weighted average lease expiry (WALE) by gross revenue (in years) in the table below:

| FY2015 | FY2016 | FY2017 | FY2018 | FY2019 | |

| Portfolio Occupancy (%) | 100.0% | 100.0% | 100.0% | 100.0% | 99.7% |

| Portfolio WALE (years) | 9.1 years | 8.4 years | 7.9 years | 7.1 years | 6.5 years |

While the REIT’s portfolio occupancy have been fully occupied over the years (with the exception of FY2019, where its portfolio occupancy dipped slightly), its portfolio WALE have been trending down.

Particularly, 58.56% of the leases are set to expire in FY2022 – in my personal opinion, whether or not the REIT can continue to record improve top- and bottom-lines in the years ahead largely depend on whether or not they are able to renew the expiring leases at favourable terms.

Parkway Life REIT’s Distribution Payout to Unitholders between FY2015 and FY2019

If you are those who prefer to invest in companies that distributes a distribution payout every quarter, Parkway Life REIT is one of them you may be interested in, as the management declares a distribution payout to its unitholders on a quarterly basis.

The following table is the REIT’s distribution payouts over the past 5 financial years:

| FY2015 | FY2016 | FY2017 | FY2018 | FY2019 | |

| Distribution Per Unit (S$’cents/unit) | 13.29 cents | 12.12 cents | 13.35 cents | 12.87 cents | 13.19 cents |

As I’ve mentioned earlier, the drop in distributions in FY2016 and FY2018 were due to the lack of one-offs (divestment gains) which were distributed to the unitholders in the preceding years respectively.

Key Financial Performance of Parkway Life REIT in 1H FY2020 (Compared to 1H FY2019)

On 28 July 2020, Parkway Life REIT released its financial results for the first half of financial year 2020 (i.e. 1H FY2020), and in this section, let us take a look at the REIT’s key financial performances in the midst of the Covid-19 pandemic (where many companies reported weaker y-o-y results):

| 1H FY2019 | 1H FY2020 | % Variance | |

| Gross Revenue (S$’mil) | $57.3m | $60.1m | +5.1% |

| Net Property Income (S$’mil) | $53.3m | $56.0m | +4.9% |

| Distributable Income to Unitholders (S$’mil) | $39.7m | $40.4m | +1.9% |

| Distribution Per Unit (S$’cents/unit) | 6.55 cents | 6.68 cents | +2.0% |

As you can see from the table above, even in the midst of the Covid-19 pandemic, the REIT’s results continued to remain resilient.

The 5.1% y-o-y growth in its gross revenue was due to revenue contribution from the 3 Japan nursing rehabilitation facilities acquired in Q4 FY2019, higher rent from its Singapore properties, along with the appreciation of Japanese Yen (against the Singapore dollar.)

As a result, its net property income and distributable income to unitholders went up by 4.9% and 1.9% on a y-o-y basis respectively.

However, do take note that the REIT have retained the remaining S$850,000 as part of the S$1.7m Covid-19 related relief measures for tenants announced in Q1 FY2020.

In Conclusion

To conclude, what I like about the REIT is its ability to record improvements in its financial results over the years, especially in 1H FY2020, where they still manage to record a resilient set of results compared to last year even in the midst of the Covid-19 pandemic. I also like the REIT’s conservative debt profile, and its portfolio occupancy (which is fully occupied.)

The only thing I don’t feel too comfortable with is the fact that more than half of its leases are set to expire in FY2022, and as I’ve mentioned earlier, whether or not the REIT can continue to record improvements in its top- and bottom-line in the years ahead will very much depend on whether these expiring leases can be renewed on favourable terms.

Having said that, however, this post is meant for educational purposes only, and does not imply any buy or sell recommendations for the REIT’s units. Please do your own due diligence before you make any investment decisions.

Disclaimer: At the time of writing, I am not a unitholder of Parkway Life REIT.

Are You Worried about Not Having Enough Money for Retirement?

You're not alone. According to the OCBC Financial Wellness Index, only 62% of people in their 20s and 56% of people in their 30s are confident that they will have enough money to retire.

But there is still time to take action. One way to ensure that you have a comfortable retirement is to invest in real estate investment trusts (REITs).

In 'Building Your REIT-irement Portfolio' which I've authored, you will learn everything you need to know to build a successful REIT investment portfolio, including a list of 9 things to look at to determine whether a REIT is worthy of your investment, 1 simple method to help you maximise your returns from your REIT investment, 4 signs of 'red flags' to look out for and what you can do as a shareholder, and more!

You can find out more about the book, and grab your copy (ebook or physical book) here...

Comments (2)