As a retail investor, one of the things I do on a consistent basis is to keep a lookout for fundamentally-sound companies to invest my money in – some of the key things I look at include their financial performances (it must be one that has recorded consistent improvements over the years), as well as its debt profile (where it has minimal or no debt.)

Today, I’d like to share with you researches I have done in another company that has caught my eye – Yum China Holdings Inc. The company is dual-listed on the New York Stock Exchange (under the ticker symbol NYSE:YUMC), as well as on the Hong Kong Stock Exchange (under the ticker symbol HKEX:9987.)

Before I dive in to share about the company’s financial performance, debt profile, as well as dividend payouts, allow me to first share a brief introduction about the company – from a single restaurant in 1987, Yum China is China’s largest restaurant company with over 10,000 restaurants located in over 1,400 cities and towns spanning every provinces and autonomous region across Mainland China. It operates the following restaurant brands:

- East Dawning (东方既白) – a Chinese food quick service restaurant brand specialising in Jiangnan cuisine, with 8 outlets in total located in buzzing transportation hubs

- Little Sheep Hot Pot (小肥羊) – a well-known hot pot restaurant in China with over 270 outlets in China and in international markets as at December 2020. You can find out more at www.littlesheep.com

- Huang Ji Huang (黄记煌) – a leading Chinese-style casual dining franchise restaurant brand. As at December 2020, it has over 600 restaurants in China as well as internationally. You can find out more at www.huangjihuang.com

- COFFii & JOY – a new coffee concept developed by Yum China in 2018, featuring specialty hand-dripped coffee. As at December 2020, there are 42 outlets all located in China

- KFC – this fast food chain needs no further introduction (as there are also many KFC outlets scattered all over Singapore.) Yum China owns exclusive rights to operate and sub-license the KFC brand in China. As at December 2020, there are over 71,000 KFC restaurants in over 1,500 cities across China

- Pizza Hut – another restaurant that we Singaporeans are familiar with, and another brand that Yum China has exclusive rights to operate and sub-license. As of December 2020, they have opened 2,300 Pizza Hut restaurants in over 500 cities in China

- Taco Bell – a Mexican-inspired quick service restaurant brand which Yum China also has the exclusive rights to operate and sub-license. As at December 2020, the company has opened 12 outlets in China. You can find out more at www.tacobellchina.com

Now that you have a better understanding of the company’s businesses, let us move on and take a look at its historical financial performance, debt profile, as well as its dividend payout to shareholders in the sections below:

Financial Performance between FY2017 and FY2020

As the company only became an independent publicly-listed company on 01 November 2016 on the NYSE, I will be studying its full-year financial performance (the company has a financial year-end every 31 December) between FY2017 and FY2020 (the company have just released its full-year results on 03 February 2021):

Total Revenue, Net Profit, and Net Profit Margin:

| FY2017 | FY2018 | FY2019 | FY2020 | |

| Total Revenue (US$’mil) | $7,769m | $8,415m | $8,776m | $8,263m |

| Net Profit (US$’mil) | $398m | $708m | $713m | $784m |

| Net Profit Margin (%) | 5.1% | 8.4% | 8.1% | 9.5% |

Yum China’s total revenue saw year-on-year (y-o-y) improvements in 3 out of the 4 years I’ve looked at – the decline in FY2020 was due to temporary closures of their restaurants due to lockdowns implemented by the Chinese government to stop the further spread of Covid-19 outbreak in the country. Over a 4-year period, its total revenue grew at a compound annual growth rate (CAGR) of 1.6%.

On the other hand, its net profit saw improvements in all the 4 years I’ve looked at, recording a CAGR of an impressive 18.5%.

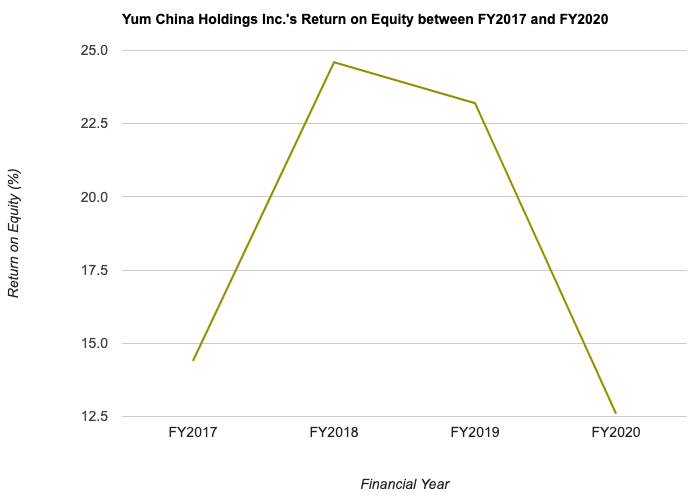

Return on Equity (%):

For those who are new to this term, Return on Equity (RoE), in layman terms, is the amount of profits (in percentage terms) the company is able to generate for every dollar of shareholders’ money it uses in its businesses. My preference is towards companies that are able to record a RoE of above 15.0% consistently.

With that, let us take a look at Yum China’s RoE over a 4-year period which I’ve calculated:

| FY2017 | FY2018 | FY2019 | FY2020 | |

| Return on Equity (%) | 14.4% | 24.6% | 23.2% | 12.6% |

Since recording a high of 24.2% in FY2018, its RoE have fallen in the subsequent years. At 12.2% recorded in FY2020, it is the lowest in the 4 years I’ve looked at (however, we need to bear in mind that the company’s businesses were adversely affected by the lockdown implemented by the Chinese government.)

With China having successfully kept the community spread of the virus under control, its population gradually being vaccinated, and businesses have since resumed operations, I am positive of a better set of results (and hence in its RoE) in the year 2021 ahead.

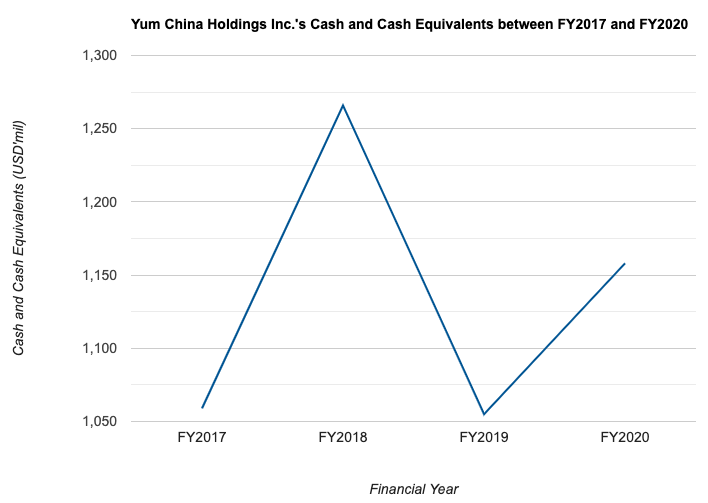

Debt Profile between FY2017 and FY2020

Another area I look at, apart from a company financial performance, is its debt profile. In this regard, I’m happy to note that the company does not have any borrowings. As such, it is in a net cash position in all the 4 years (between FY2017 and FY2020) I’ve looked at:

| FY2017 | FY2018 | FY2019 | FY2020 | |

| Cash & Cash Equivalents at the End of Period (US$’mil) | $1,059m | $1,266m | $1,055m | $1,158m |

Over the 4-year period, Yum China’s cash and cash equivalents have consistently hoovered between the US$1,000m and US$1,200m range.

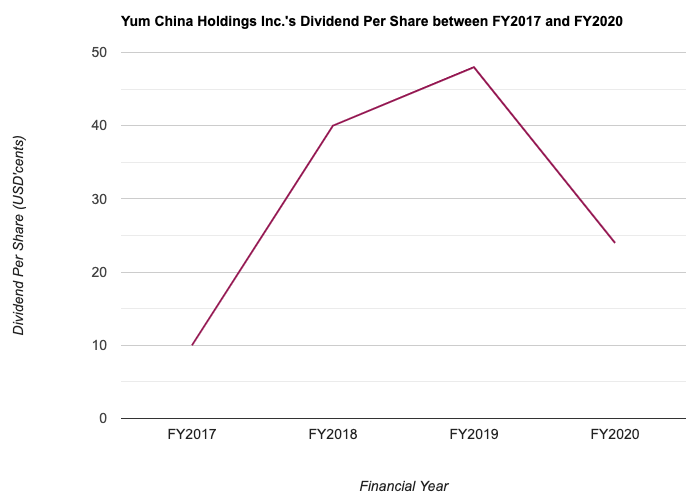

Dividend Per Share between FY2017 and FY2020

Apart from in FY2017 (where there was only one payout of 10.0 cents/share in the fourth quarter), and in FY2020 (where there were two payments of 12.0 cents/share in the first and fourth quarter), the remaining years saw the company paying out a dividend to its shareholders on a quarterly basis.

The following table is Yum China’s dividend payouts to its shareholders in the past 4 years, along with its payout ratios (which is the percentage of earnings that the company pays out as dividends to its shareholders) I’ve computed:

| FY2017 | FY2018 | FY2019 | FY2020 | |

| Dividend Per Share (USD’cents) | 10.0 cents | 40.0 cents | 48.0 cents | 24.0 cents |

| Dividend Payout Ratio (%) | 10.0% | 22.3% | 26.1% | 12.3% |

Over a 4-year period, while its dividend payout grew at a CAGR of 24.5%, but its payout ratio have never crossed above 30.0% – meaning the company have kept a majority of its earnings for further growth in its businesses.

Is the Current Share Price of Yum China Holdings Inc. Considered Cheap or Expensive?

One of the ways I use to determine whether or not the share price of a company is considered cheap or expensive is to take its current valuations (based on its current share price) and compare against its historical valuations.

At the time of writing, Yum China is trading at US$64.35, and its current valuations is as follows:

P/E Ratio: 34.5

P/B Ratio: 4.4

Dividend Yield: 0.4% (calculated based on its total dividend payout of 24.0 cents/share in FY2020)

The following is the company’s valuations over the past 4 years I’ve calculated, along with its average:

| FY2017 | FY2018 | FY2019 | FY2020 | Average | |

| P/E Ratio | 40.0 | 18.7 | 26.1 | 29.3 | 28.5 |

| P/B Ratio | 5.6 | 4.4 | 5.9 | 3.9 | 4.9 |

| Dividend Yield | 0.2% | 1.2% | 1.0% | 0.4% | 0.7% |

Comparing its current valuations against its 4-year average, it seems that the current share price of Yum China is considered expensive due to its higher-than-average current P/E ratio, along with a lower-than-average current dividend yield.

In Conclusion

Yum China’s 3 year growth in its total revenue was stopped in its tracks as a result of the outbreak of the Coronavirus in the year 2020, which led to the Chinese government implementing lockdowns and making its population stay home to prevent the further spread of the virus in the community. This has negatively affected many businesses and Yum China wasn’t spared from it as well.

However, at the time of writing, China have managed to keep the number of new daily cases between zero and low single digit, and businesses have since resumed their operations. With that in mind, barring another big wave of outbreak (and another round of lockdown measures similar to last year), I am of the opinion that Yum China’s growth could continue in the year 2021 ahead, and its financial performance recording improvements compared to the previous year.

With that, I have come to the end of my share on the researches I’ve done on Yum China Holdings Inc. I hope you have enjoyed the read and have benefitted from the contents within. However, do take note that this does not represent any buy or sell calls for the company’s shares. Please do your own due diligence before you make any investment decisions.

Disclaimer: At the time of writing, I am not a shareholder of Yum China Holdings Inc.

Are You Worried about Not Having Enough Money for Retirement?

You're not alone. According to the OCBC Financial Wellness Index, only 62% of people in their 20s and 56% of people in their 30s are confident that they will have enough money to retire.

But there is still time to take action. One way to ensure that you have a comfortable retirement is to invest in real estate investment trusts (REITs).

In 'Building Your REIT-irement Portfolio' which I've authored, you will learn everything you need to know to build a successful REIT investment portfolio, including a list of 9 things to look at to determine whether a REIT is worthy of your investment, 1 simple method to help you maximise your returns from your REIT investment, 4 signs of 'red flags' to look out for and what you can do as a shareholder, and more!

You can find out more about the book, and grab your copy (ebook or physical book) here...

Comments (0)