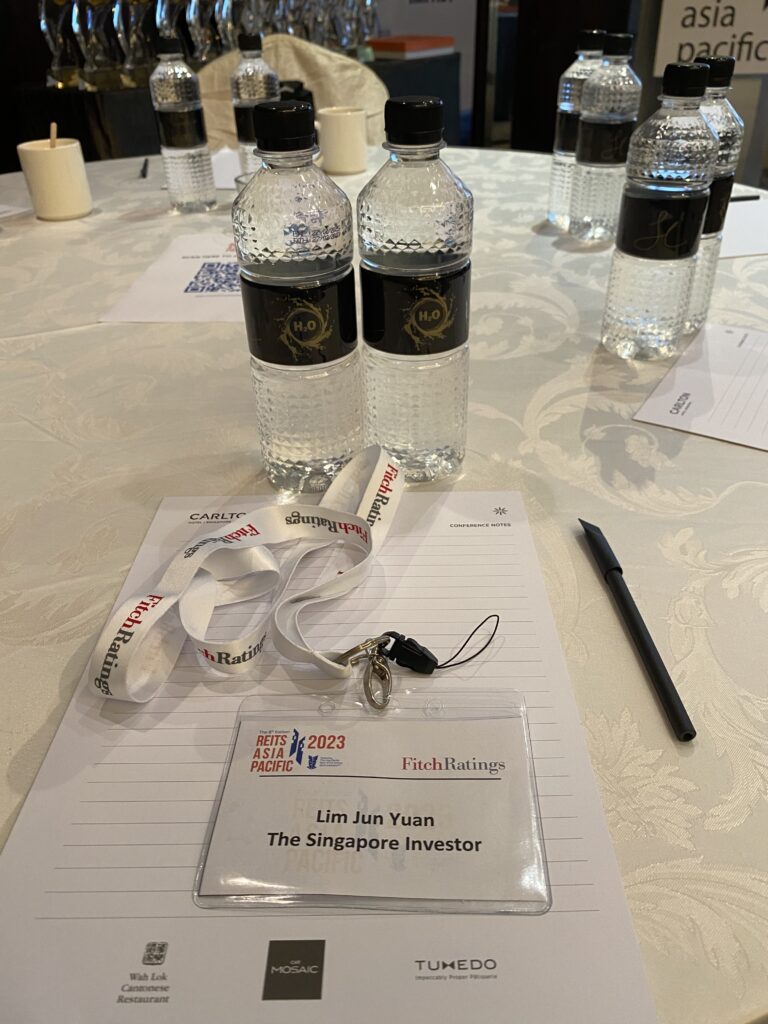

Yesterday (16 March 2023), I had the honour of attending the 8th edition of REITs Asia Pacific 2023 held at Carlton Hotel Singapore as a media partner:

The event was attended by representatives of 9 REITs listed in Singapore (BHG Retail REIT, Cromwell European REIT, IREIT Global, Lendlease Global Commercial REIT, and United Hampshire US REIT), Malaysia (Axis REIT, and Sunway REIT), India (Embassy REIT), as well as on the Philippines (AREIT Inc.) stock exchanges.

Apart from the award presentation (for the Asia Pacific Best of the Breeds REITs Award 2023), there were also a series of panel discussions, and in this post, you’ll find some of the key takeaways from each of them, which I’ve compiled and sharing here so everyone can benefit:

Panel Discussion 1: Will Asian Logistics/Industrial REITs Continue to Outperform in 2023?

(Moderator: Ms Wong Ee Kean, CEO of GSUM-Titanland Capital, Panelists: Mr Hasira De Silva, Senior Director in Fitch Ratings, and Mr Nicholas Teh, Head of Securities Research for Singapore, Credit Suisse)

- Logistics sector was very resilient during the Covid-19 pandemic due to a huge jump in online sales volume, along with REITs acquiring properties to cope with the rising demand for warehouse spaces, and at the same time, with taking advantage of the low interest rate environment to grow their portfolio.

- Industrial sector, however, was more affected, particularly from tenants that were adversely impacted by the pandemic.

- With interest rates on the rise, these REITs are now “victims of their own successes”, where distribution growth rate are set to slow due to the decline in the number of acquisition activities. This led to investors switching out of REITs into other higher yielding investment instruments.

- Moving forward, REITs can look to grow by divesting matured properties and recycling the capital into newer assets (instead of borrowing.)

- Also, in times like this, having a clear growth strategy, acting in a transparent manner, along with stress-testing becomes all the more important.

- That said, on the whole, the opinion is that S-REITs are well-managed, where 60-70% of their borrowings are hedged at fixed rates. Funding diversity will help to manage risks posed by the high interest rate environment.

Panel Discussion 2: Can Asia’ REIT Market Thrive Amid High Inflation Cost?

(Moderator: Mr Govinda Singh, Specialist Portfolio Advisors & Valuers at Colliers’, Panelists: Ms Wong Ee Kean, CEO of GSUM-Titanland Capital, Ms Carol Torres-Mills, Vice President of Ayaland Land Inc., and CEO of ARIET Inc. (the Philippines), Mr Kelvin Chow, CEO of Lendlease Global Commercial REIT)

- In times like this, it becomes imperative for the REITs’ management to take stock of their corporate strategy, and take steps to make ensure the REITs continue to relevant (by diversifying within their respective sectors.)

- On whether rentals received (from tenants) can help to fight inflation, some of the things that can be looked at include length of leases (shorter-term leases vs. Longer-term leases), rental escalations to protect against potential downsides, along with tenant mix (where the getting right tenants can help to sustain inflation pressure.)

- Some of the challenges for REITs management include avoiding impairment, capital management, and at the same time, maintaining distributions.

- In terms of whether S-REITs are able to cope with the current economic headwinds, the view is that, compared to the Great Financial Crisis back in 2008, they are now much better equipped with tools to help them better manage financing costs. Also, there are guidelines put in place by the Monetary Authority of Singapore (MAS) to prevent REITs from running into a big risk.

- On the possibility of further hedging (to fixed rates), the opinion is that it is not so favourable now as interest rates are at a high point.

- Finally, as financing becomes more expensive, it becomes imperative to study the fundamentals of the individual assets prior to making any acquisition. The key now is to bring the right assets (that is future-proof, yield-accretive, and provides a good growth story) to the REITs’ portfolio.

Presentation: Is this the Best Time to Invest in Technology for the REITs Market?

(Speaker: Mr Bernie Devine – Senior Director, Asia Pacific, Yardi Systems, Inc.)

- In an Australia and New Zealand Proptech Survey 2023, it was found that:

- one-third of the respondents nominated artificial intelligence (AI) as having the biggest impact on technology;

- out of 10 respondents, 5 are still using spreadsheets for budgeting and projections, which they opined should well and truly be automated – and this represents an opportunity for AI;

- ESG (Environmental, Social, and Governance) isn’t going anywhere anytime soon. With 40% of the world’s carbon emissions coming from buildings, it makes proptech important when solving business problems.

- REITs can claim market position with ESG, with the best time to invest in technology to achieve this being this very moment.

Panel Discussion 3: How Important is ESG to the REITs Market?

(Moderator: Mr Cedric Rimaud, Sustainability Consultant of Climate Finance Asia, Panelists: Dr Chew Tuan Chiong, Former Director and CEO of Frasers Centrepoint Trust, Ms Priyaka Dhingra, Associate Director of KPMG ESG)

- ESG is now a “need to have” rather than “nice to have”, especially if S-REITs want to be benchmarked against those listed on global exchanges. Singapore stands shoulder-to-shoulder with other exchanges in terms of these challenges.

- Currently, there are lots of balance scorecards, rules and practices (one example is GRESB) on ESG. However, one problem being highlighted is that it is all encompassing, leading to a situation where, “when everything becomes important, nothing is important.”

- Hence, when the REIT management implement the ESG measures, it is important they know what is the intent.

Closing Thoughts

Events like this are good opportunities for me to learn from the industry experts (and personally, I’ve benefited immensely from the panelists’ sharing) during the panel discussion, as well as after that.

Many thanks once again to the event organiser, The Pinnacle Group International, for the invite!

Finally, for those who are reading this particular post, I really do hope you’ve found my summary of the panel discussions useful.

Are You Worried about Not Having Enough Money for Retirement?

You're not alone. According to the OCBC Financial Wellness Index, only 62% of people in their 20s and 56% of people in their 30s are confident that they will have enough money to retire.

But there is still time to take action. One way to ensure that you have a comfortable retirement is to invest in real estate investment trusts (REITs).

In 'Building Your REIT-irement Portfolio' which I've authored, you will learn everything you need to know to build a successful REIT investment portfolio, including a list of 9 things to look at to determine whether a REIT is worthy of your investment, 1 simple method to help you maximise your returns from your REIT investment, 4 signs of 'red flags' to look out for and what you can do as a shareholder, and more!

You can find out more about the book, and grab your copy (ebook or physical book) here...

Comments (0)